Homeownership – Your way to financial security.

The #1 American dream is to own a home. There are many reasons for this. Studies show homeowners are happier and have higher self-esteem. Owning a home gives us more control over our lifestyles. It allows us to create a place that is truly our own. If you rent, you can’t remodel, build an addition, create a stunning landscape or even choose the outside paint color. But the one benefit of home ownership that impacts our lives the most is the wealth, over time, we gain from it.

New data from the US Census Bureau shows that homeowners have a net worth 80 times larger than renters. What are the two biggest contributors? Home equity and retirement accounts. The average homeowner has a household wealth of $255,000 compared to the average renter who has a household wealth of a meager $6,300.

We all need a place to live. We will either rent or own. If we rent, we pay the property owner (landlord) a monthly rental fee. If we own, we pay a monthly home loan payment. No matter where we live, rent or own, it costs money. So, why would someone rent rather then own?

Why Renters Rent

For most of us, owning a home will be the largest financial obligation of our lives. Every first-time homebuyer finds it daunting to consider the massive debt and long-term obligation that buying a home requires. It’s scary, no doubt. It’s a fear every homeowner has had to overcome. This alone is often enough to stop a renter from becoming a home owner. But there are other reasons why we choose to rent or cannot buy. These include:

- The freedom to change our location and move when and where we want and can afford.

- A job that is not secure or may require relocation

- Not wanting to pay for or deal with repairs and maintenance

- Not enough cash to purchase

- High debt

- Pour credit or no credit to qualify for a home loan

The lifestyle reasons to rent rather than own are optional. Even though we could buy a home we choose not to for what ever reason. Not having the cash, good credit and high debt makes a home purchase impossible even if we wanted to buy.

The Benefits Of Being A Homeowner

It’s true, buying a home can be hard to do. It can be a strain financially, mentally and emotionally. But history proves and studies show there is no better way to achieve financial security and live happier with higher self-esteem than through homeownership. So what are these benefits that make us want to own a home? The benefits far outweigh the fears and risks.

- Social Benefits

- Increased Self-esteem & Happiness.

A number of studies reveal that homeowners have higher self-rated health, higher perceived control over their lives and higher self-esteem and happiness ratings than renters1. Simply put, we feel better about ourselves and enjoy our lives more when we own a home. - Neighborhood Stability & Engagement.

Homeowners are less transitory – they live in the same neighborhood longer than renters who move often. This brings stability and a sense of community to neighborhoods. Neighbors know each other and have for long periods of time. Homeowners are more likely to participate in local elections, civic groups and neighborhood organizations than renters. The result is that homeowners bring a more stable neighborhood environment with lower crime rates. - Lifestyle Control

Homeowners have much more control over their lifestyles. They have the freedom to customize, remodel and landscape how they choose. They can create a home to look and function specifically for their wants and needs. They are happier and have pride-of-ownership that results in better maintained neighborhoods than rental properties.

- Building Asset-Wealth

Asset-wealth is the value of the things you own. Your asset-wealth is a much more secure predictor of future financial security than income and, for most of us, our home will become our most valuable asset. This asset-wealth is equity, the difference between your homes value and the amount you owe. There are three fundamental reasons the equity in your home will increase over time; Principal Reduction, Improvement Values and Appreciation. - Principal Reduction

Because your home loan is amortized over a period of time, you will be paying it down every month. Though this is minimal in the early years it adds up. Every year that passes you will owe less and increase your equity helping build your asset-wealth. If you had a 30 year mortgage and kept your home for 30 years, you would pay off your entire mortgage and own your home free and clear creating real wealth and financial security. - Improvement Values

Another way to increase value and thereby increase your equity is by make valuable improvements in the property. This could be remodeling the kitchen or bathrooms, installing new landscaping or building an addition. These renovations usually earn you more in value than they cost. - Appreciation

If you own a home or are considering buying one, you have most likely heard the term, “appreciation.” Merrian-Webster defines appreciation as simply, “increase in value.” Appreciation is based entirely on the value of your property. When the value increases, your home appreciates. Historically real estate has consistently increased in value. But what happens when the value goes down or depreciates?

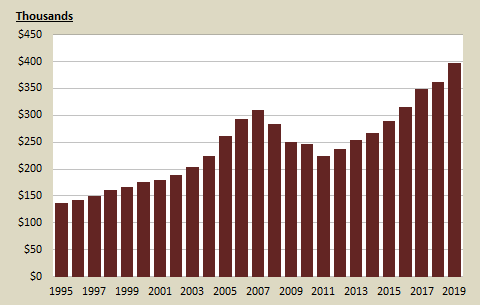

We recently went through one of the worst periods of property depreciation in recent history. The 2008 recession resulted in property values dropping around 33% across the US. By 2013 home values and risen back to their 2007 highs and by 2018 had increased by 50%. This was the longest period of value decline in modern times. In most cases, periods of value loss tend to be short-lived, lasting a few years, followed by strong appreciation. Consider this, the median home value in the US in 1980 was $47,200. In 2020 it had risen to $320,000. In addition, thinking purely as an investment, a home is less vulnerable to short-term fluctuations that occur in the stock market and other investments.

“Don’t wait to buy real estate, buy real estate and wait.”

This quote by Will Rogers a century ago has proven true for more than 100 years. Real estate goes up in value. It appreciates. It has since the dawn of time. Understanding how it affects you as a home buyer is not emphasized enough. Understanding appreciation will confirm why, if you are able to buy, waiting to buy is rarely a good idea. The average annual appreciation for the past decade has been about 5.4%. Because appreciation is based on the total value of the real estate, not the money you invest in buying it, the increase is nearly impossible to keep up with.

Consider the Buy Today and Buy 3 Years From Today examples below. They are based on the average annual appreciation of 5.4%, as well as current average interest rates and purchase costs. Of course, these are just examples. Your costs, down payment, interest rate and annual appreciation may be less or greater.

The average annual appreciation for the past decade has been about 5.4%. Because appreciation is based on the total value of the real estate, not the money you invest in buying it, the increase is nearly impossible to keep up with.

Consider the Buy Today and Buy 3 Years From Today examples below. They are based on the average annual appreciation of 5.4%, as well as current average interest rates and purchase costs. Of course, these are just examples. Your costs, down payment, interest rate and annual appreciation may be less or greater.

BUY TODAY EXAMPLE

- You buy a house today for $400,000.

- Your VA benefit allows you secure a 0% down payment home loan. Your loan amount would be $400,000 with no upfront cash for the down payment.

- Your closing costs come out to 3.5% of your loan amount which would be $14,000 cash at time of closing.

- You qualify for a 3% 30 year VA loan making your payments $1,852.87 per month not including property taxes and insurance. Even with taxes and insurance you would be paying about the same, maybe even less, then if you rented a similar property.

- At the end of 3 years your home would be worth $456,466. You would have more then $56,000 equity!

BUY 3 YEARS FROM TODAY EXAMPLE

Ask yourself, what would happen if I waited 3 years? That same home, due to appreciation at 5.4% annually, would now cost you:- $456,466 purchase price and mortgage amount.

- $15,976 cash for closing costs.

- $2,202 monthly payments plus property taxes and insurance.

- $15,976 cash for closing costs.

Had you purchased today instead of 3 years from now, you would have more than $56,000 in equity due to appreciation. By waiting 3 years you lose that $56,000 in appreciation and would owe $56,000 more on your mortgage and your monthly payment would be nearly $350 higher.

The choice is obvious, buy today and build wealth. Buy tomorrow and lose wealth.

With that said, you need to be able to have your finances in order and enough cash available to purchase a home. So save, don’t spend. Start today on credit repair and building. Make a Home Buying plan and stick with it so, as quickly as possible, you can buy your home.

We are happy to answer your questions and help you get on a home buying plan. Just send us a message. To enroll and start your home hunt, GO HERE.

- Tax Benefits

- Your Home Loan Interest & Property Taxes Are Deductible

For the first 15 years of your 30 year home loan, your home loan interest will most likely be your largest homeowner expense. The interest you pay on your home loan is tax deductible. This can reduce your tax liability substantially. We are not accountants and encourage you to talk with one for your specific situation, but for example, if you were in a 25% tax bracket and you paid $15,000 of mortgage interest in a year, you may be able to deduct that entire amount off you income. That deduction would save you $3,750 off your tax debt (25% of $15,000 interest). It may even drop you into a lower tax bracket which may save you even more because your entire tax liability would be less. In essence you would be saving $312 each month on your mortgage payment.

Not only is your home loan interest tax deductible but so is your property tax. The national average of state property taxes is 1.07%. That means, on a $400,000 home, your annual property tax would be $4,280 annually. That entire amount can be deducted from your annual income. Using the same 25% example above, your savings would be $1,070 on your tax debt, reducing your monthly mortgage liability by an additional $89.

No part of a rental payment is tax deductible. With today’s low interest rates and the mortgage tax deduction available, will you really be paying more monthly if you owned? Contact us HERE if you would like to know. We can help evaluate your situation.

- Profit Exclusion & Capital Gains

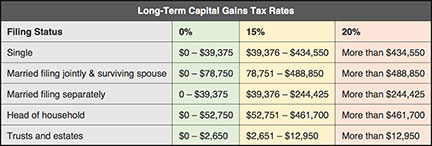

Did you know that up to $250,000, or $500,000 if you file jointly with your spouse, of the capital gain from the sale of your main home may be excluded from any tax liability? That’s a huge benefit that could save you tens of thousands of dollars in taxes owed. In addition, any gain above and beyond your exclusion, provided you’ve owned your home for more then a year, is considered a long-term capital gains. Long-term capital gains are much lower than the corresponding tax rates for standard income. The percentage you pay on your capital gains depends on your filing status and how much money you made in the year of your sale. The highest you would pay on any long-term capital gain is 20%. This would be substantially less then if you had to claim the gain as regular income which would be 37%. Look at the long-term capital gains tax table to see where you may land.

Did you know that up to $250,000, or $500,000 if you file jointly with your spouse, of the capital gain from the sale of your main home may be excluded from any tax liability? That’s a huge benefit that could save you tens of thousands of dollars in taxes owed. In addition, any gain above and beyond your exclusion, provided you’ve owned your home for more then a year, is considered a long-term capital gains. Long-term capital gains are much lower than the corresponding tax rates for standard income. The percentage you pay on your capital gains depends on your filing status and how much money you made in the year of your sale. The highest you would pay on any long-term capital gain is 20%. This would be substantially less then if you had to claim the gain as regular income which would be 37%. Look at the long-term capital gains tax table to see where you may land.

Make A Home Purchase Plan

Do you want to move from renter to homeowner? The first thing you should do is make a Home Purchase Plan. It will tell you if you can start looking today or if you need follow your plan to make your homeownership dream come true.

According to an AARP study, more than half of Americans spend more than they earn and 70 percent think their debt is problematic. There’s always a nicer car or new toy or hobby we enjoy. Travel, adventure, fashion and technology are all expensive. Expensive choices like these devour our incomes, build debt and cause substantial mental strain.

The good news is there is hope to become financially capable to buy a home. The first step to achieving your home buying dream is to create a Home Purchase Plan. A Home Purchase Plan is a financial road map that will guide you and hold you accountable to reach your homeownership dream. This plan should include:

1Budget - Create a spending budget that cuts spending to only what is required.

2Debt reduction - determine how much monthly you can commit to reducing debt and how long it will take for you to get to a zero balance.

3Credit Repair - Once a year you can get your credit reports for free at annualcreditreport.com. This will show what is negatively affecting your score. Fix those items. If you need help, use Google to research credit repair counselors and hire one. They may be able to negotiate your debts for less than you owe and dispute those that should be removed.

4Determine how much house you can afford - Contact a home loan officer to review your finances tell you what you can expect to qualify for. Contact us for a home loan referral.

5Save - You will need to save enough for a down payment, closing costs and move-in expenses. Your home loan officer should be able to give you a target point. Military Home Services Real Estate Benefit will help save you thousands. Learn more here.

6Save a reserve - Though not required, if possible it’s a good idea to have a cash reserve. Typically this should be two or three months to cover your mortgage payments and expenses. How much of a reserve will depend on your job security and income growth potential.

7Time Schedule - Determine and commit to a schedule to accomplish the elements of your plan and a date for completion.

Once your Home Purchase Plan is completed, your house hunt begins. To learn more about that process, GO HERE.

If you are ready to move forward, ENROLL HERE. We will help you get started on your road to homeownership.

1https://info.bankofamerica.com/homebuyers-report/

https://www.nar.realtor/blogs/economists-outlook/highlights-from-social-benefits-of-homeownership-and-stable-housing